Federal Business Zones

The Federal Government has several designations for geographic locations to incentivize investment in these areas or benefit businesses operating in those areas. Federal business zones within Glynn County, GA include Foreign Trade Zone #144, the Federal Opportunity Zone Program, and the SBA’s HUBZone program.

Foreign Trade Zones in Georgia

Foreign Trade Zones are a huge advantage to businesses that import and export goods. Locating a business within a Foreign Trade Zone allows a company to delay paying duties. There are several other benefits to locating within a Foreign Trade Zone.

Foreign Trade Zone #144

The Brunswick and Glynn County Development Authority is the Grantee of Foreign Trade Zone #144 (FTZ #144), one of three Foreign Trade Zone Grantees in Georgia. The other two are headquartered in Atlanta and Savannah. Foreign Trade Zone #144 covers most of Southeastern Georgia, bounded by I-75 on the west, McIntosh County, and Dublin, GA on the north.

By becoming a sub-zone grantee of a Foreign Trade Zone, manufacturers are allowed to delay paying U. S. Duty fees on imported goods (raw materials, finished goods, partially finished goods, etc.) by temporarily staging these products within the designated boundaries of an FTZ sub-zone. While in this sub-zone, these products can be upgraded, repaired, or modified without paying the duty. If the products were then directly exported back off-shore without actually entering the United States officially, no U. S. duty would be paid. However, if the finished product were shipped from the FTZ sub-zone to a final destination within the United States, then the receiving company would be liable for the U. S. duty owed on the product.

The greatest benefit for FTZ sub-zone grantees arises from products having a very high value. Within FTZ #144, the majority of materials passing through the various designated sub-zones are automotive vehicles. Other current sub-zones are importing high value metals and products for processing and then returning them overseas for installation into the final product. During 2014, the value of products passing through Foreign Trade Zone #144 totaled over 5.2 Billion dollars!

Foreign Trade Zone Savings Calculator

Use the following calculator to estimate your company’s potential savings from operating with foreign-trade zone status.

Common Questions About Foreign Trade Zones

Federal Opportunity Zone Programs and Opportunity Zones in the Golden Isles

The Federal Opportunity Zone Program is a community and economic development tool that drives long-term private investment into low-income communities throughout the country. The program encourages investors with recently realized capital gains to invest in real estate or development projects in exchange for reduced tax obligations.

Incentives

The following incentives are offered to investors for putting their capital to work in these qualified opportunity zones:

Temporary, capital gain tax deferral:

- The period of capital gain tax deferral ends upon 12/31/2026 or an earlier sale

A step-up in basis:

- Investment held for 5 years – Basis increased by 10% of the deferred gain (90% taxed)

- Investment held for 7 years – basis increased by another 5% of the deferred gain (85% taxed)

Forgiveness of additional gains:

- Investment held for 10 years – Basis equal to fair market value; the forgiveness of gains on appreciation of investment of sale or exchange of Opportunity Fund investment. This exclusion only applies to gains accrued after investment in an Opportunity Fund.

The IRS and the U.S. Treasury have posted a list of Frequently Asked Questions about Opportunity Zones.

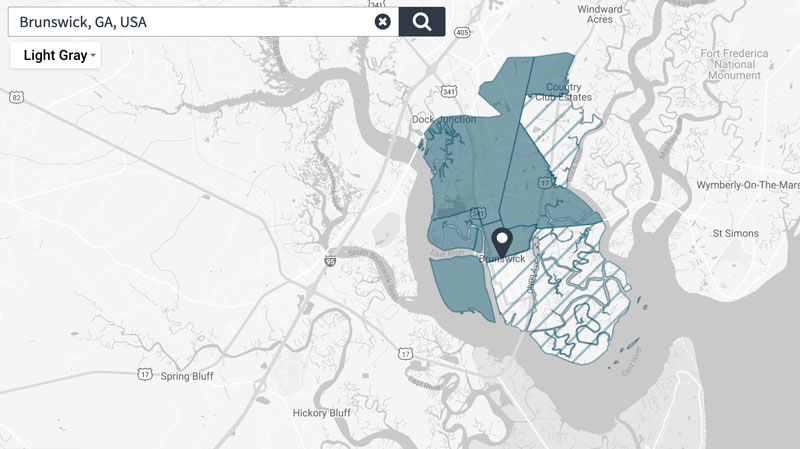

Opportunity Zone Viewer

To find eligible Opportunity Zones in the City of Brunswick, GA please use the map below. Visit Opportunity Brunswick for more information.

HUBZone Program in the Golden Isles

If your small business is located in a designated HUBZone, it may be eligible for set-aside government contracts. The HUBZone program fuels small business growth in historically underutilized business zones with a goal of awarding at least three percent of federal contract dollars to HUBZone-certified companies each year.

Program Benefits

The government limits competition for certain contracts to businesses in historically underutilized business zones. It also gives preferential consideration to those businesses in full and open competition.

Joining the HUBZone program makes your business eligible to compete for the program’s set-aside contracts. HUBZone-certified businesses also get a 10 percent price evaluation preference in full and open contract competitions.

HUBZone-certified businesses can still compete for contract awards under other socio-economic programs they qualify for.

Contact us to learn more about the Golden Isles.

I am here and ready to provide you with the information you need to make an informed decision about locating in the Golden Isles.

Contact us to learn more about the Golden Isles.

I am here and ready to provide you with the information you need to make an informed decision about locating in the Golden Isles.

Follow us on your favorite social networks.

Let us know how we can help your business.

209 Gloucester Street, Suite 211

Brunswick, GA 31520

phone: 912-536-0844

email: info@goldenislesdev.com